The Evolution of Digital Markets 🔌📈

Reviewing the technological evolution of our democratized, derivative-laden, and vibrant Web3 economy

Table of Contents 🕹️

Introduction 🐙

v1.0 (1952 CE - 1989 CE) ☎️

v2.0 (1989 CE - 2009 CE) 🌐

v3.0 (2009 CE - Present) ✨

Further Down the Rabbit Hole 🕳️

Can the pace of technological progress continue to speed up indefinitely? Isn’t there a point at which humans are unable to think fast enough to keep up?

― Ray Kurzweil

This issue is sponsored by…

Nexus Mutual is a decentralized insurance protocol that utilizes a peer-to-peer framework similar to traditional mutual insurance models. The protocol runs on Ethereum, using cryptoeconomics to create on-chain risk-sharing pools. Anyone can become a member and purchase cover.

If you are interested in covering your crypto investments from malicious hacks, depegging events, and more, check out the link below:

I. Introduction 👾

In 1965, Gordon Moore published an article in Electronics magazine in which he noted that transistors on a microchip seemed to double every year. From this observation, he predicted that the number of transistors on a microchip would grow at an exponential rate from 60 per chip in 1965 to 60,000 in 1975. This prediction seemed crazy at the time, but nonetheless, it was realized a decade later. This prescient forecast was revised slightly to a doubling of transistors per chip every two years and renamed “Moore’s Law”, and it has been remarkably accurate over the last few decades.

The success of Moore’s Law has been attributed to advancements in computing power as innovation consistently drives down the cost, speed, and efficiency of computation. Anywhere there is reliance on computative power, one can see the rapid acceleration in growth attributed to Moore’s Law.

Financial innovation has a Moore’s Law equivalent: the growth in average daily trading volume of derivatives. From 1973 to 2014, the Options Clearing Corporation shows a doubling of volume in exchange-listed options and futures every five years. Financial derivatives are a good proxy for technological innovation in capital markets since they require more sophisticated frameworks to accurately create, price, and trade.

In this issue, we seek to contextualize the rise of crypto assets and DeFi by examining technological progress in capital markets since the advent of the computer. From auctions by candlelight in Dutch coffee shops to the cacophonous roar of Wall Street trading pits, from the high-frequency trading of securitized assets by quantitative hedge funds to the peer-to-peer crypto-asset liquidity engines of decentralized finance, our democratized, derivative-laden, and vibrant Web3 economy is the direct result of a co-evolution in technology and markets decades in the making.

II. v1.0 (1952 CE - 1989 CE) 👾

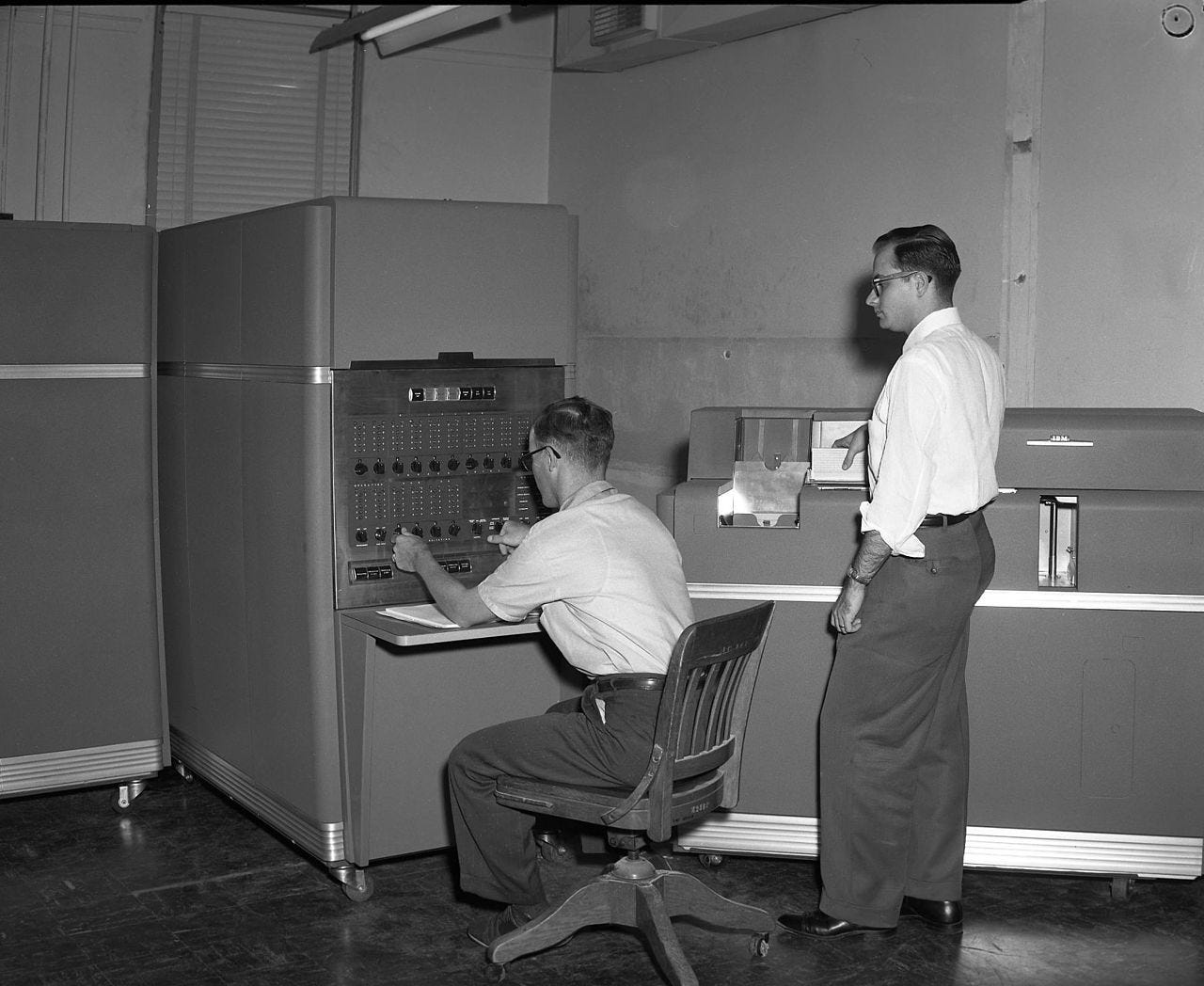

During the 1950s, the first mass-produced electronic computer, the IBM 650, went to market. The electronic computer, which had previously been limited to use by scientists and military professionals, was growing from a niche product to a general-purpose technology suitable for use in a wide variety of applications. The ability to compute enabled statistical analysis of financial data, creating a shift in financial literature from prior years.

1952 was the year Harry Markowitz developed the mean-variance theory of portfolio selection, transforming financial analysis from the company-specific ratios and discounted cash flow models of the Dodd-Graham paradigm to statistical modeling using expected returns, standard deviations, and correlations. This idea led to Modern Portfolio Theory, which was enabled at scale by the increase in computing power.

By the 1960s, just as Moore was making his technological forecasts, the first electronic clearinghouses and the NASDAQ—the first electronic exchange (although initially it was primarily an electronic quotation system for pink sheet stocks)—were opened. Computing technology during this time was allowing financial analysts to dissect market returns in a way never before possible, leading to the development of theories such as the Efficient Market Hypothesis and the Capital Asset Pricing Model. Securitization was also being developed, with the first mortgage-backed securities being offered in 1968.

Shortly thereafter in 1973, the Cboe exchange was founded and the Black-Scholes-Merton option pricing model was developed. These two events coincided around the same time the Texas Instruments SR-52, the first programmable handheld calculator capable of logarithmic and exponential functions, was released. The combination of these tools and ideas birthed the modern derivative.

The derivative came about during a period of transition. The suspension of dollar-gold convertibility and the creation of a floating exchange rate regime that replaced the fixed-rate Bretton Woods monetary system ultimately led to the creation of currency futures and forward contracts, followed by currency and interest rate swaps.

During the 70s, the SEC abolished fixed commission rates for brokerages, leading to a new wave of financial competition and innovation that birthed index funds and electronic trading technologies. Advances in trade execution, order routing, and telecommunications enabled an acceleration in the financial system’s architecture, including the creation of the Designated Order Turnaround (DOT) routing system at the NYSE and the NASDAQ’s development into a fully electronic exchange rather than just a quotation system.

By the 1980s, financial asset trading began to take advantage of the new electronic infrastructure. Quantitative analysis, building on the earlier work of Markowitz, began to flourish, with sophisticated strategies such as statistical arbitrage and algorithmic trading (at the time known as ‘program trading’) coming into use. At the same time, indexing matured after the Chicago Mercantile Exchange’s introduction of the S&P 500 futures contract.

Towards the end of the 1980s, two events seemed to signal the future challenges of the newly wired markets. The first event was Black Monday, a sudden stock market crash in 1987 that had been partially attributed to portfolio insurance strategies using derivatives. The second event was the first major financial hack—an attempted fraudulent wire transfer of $70 million from United Airlines and Merrill Lynch to banks in Austria.

Financial exchanges continued to modernize during this time. The NYSE installed the SuperDOT electronic order-routing system and NASDAQ installed the Small Order Execution System. The first Bloomberg terminal debuted in 1982, which let traders to access these new electronic interconnections. Automated trading strategies became popular alongside an uptick in statistical arbitrage strategies.

The capital markets were becoming increasingly wired.

III. v2.0 (1989 CE - 2009 CE)

The second era of digital markets was sparked by an experimental application to share data between physicists at multiple universities around the world. This platform, launched in 1989 by Timothy Berners-Lee, was known as the World Wide Web and single-handedly altered the future of human civilization, ushering in a new era of financial globalization.

However, the economic potential of the Internet was not immediately unlocked as there was no way to send secure and verifiable financial transactions over the web at the time. This finally changed by the mid-1990s when RSA encryption developed by RSA Security became the de facto standard for the industry. By ensuring security and privacy, RSA created trust in e-commerce and the electronic transmission of financial information.

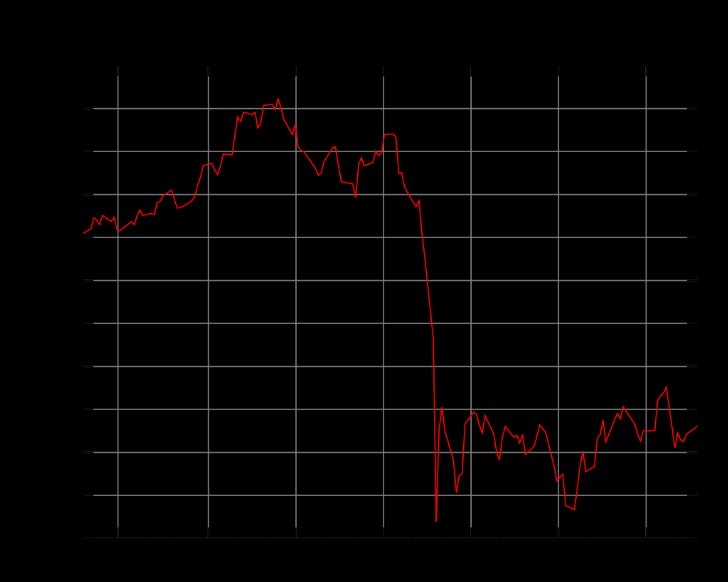

The ability to transact over the Internet fueled speculation, becoming what is now referred to as the dot-com boom. Investment poured into early Internet companies that boasted new business models enabled by global telecommunications. The NASDAQ index, which is primarily weighted toward technology companies, quadrupled from 1995 to 2000, spurred by this speculation.

Over the previous decade, interest rates had dropped, declining to below 3% by 1993. This low interest rate environment contributed to a parallel boom in derivatives as investors sought out higher yields. Yield-starved institutional investors flocked to new financial primitives in derivatives, such as junk bonds, collateralized debt obligations, and mortgage-backed securities. In addition, there was a shift in institutional investment styles toward exotic quantitative strategies such as statistical arbitrage, convertible debt arbitrage, and emerging market debt trading. This latter development was ultimately felt around the world after the Asian financial crisis hit in 1996, resulting in the destruction of Long-Term Capital Management. At the time, there were fears of financial contagion as the financial system, enabled by the Internet and derivatives, was highly interconnected.

The dot-com boom ultimately peaked in March 2000 at the same time as high-frequency trading (HFT) was coming online. HFT is a form of algorithmic trading that places buys and sells at ultra-fast speeds measured in fractions of a second. Limited by the speed of light, HFT firms competed for computer and server locations in order to get a microsecond advantage over competitors.

The following year, in response to the events of September 11th, 2001, the Federal Open Market Committee lowered interest rates while the US federal government promoted an ownership economy. This resulted in a massive extension of credit to facilitate home purchases just as collateralized debt obligations made up of mortgage-backed securities became the investment de jour for their increasingly attractive risk-adjusted yields. We all know what inevitably happened by 2008.

The 2008 financial crisis created a pervasive distrust in institutions that ultimately laid the groundwork for the coming v3.0 era.

IV. v3.0 (2009 CE - Present)

v3.0 began with two confluent events: the invention of Bitcoin and the mass adoption of the smartphone.

The adoption of the smartphone resulted in a boom in new applications as everything from ride-sharing services to robo-advisors moved to smartphone platforms. Social media consumption was on the rise and enabled a quicker transmission of cultural memes. At the same time, fintech apps made investing more simple, accessible, and cost-efficient. These two forces combined with an ultra-low interest rate environment to create the much-discussed meme stock phenomenon, a gamified community-based approach to investing. Interestingly, this phenomenon coincided with a significant uptick in derivatives trading volumes as retail investors used platforms like Robinhood to enter into calls and puts.

The other primary event of v3.0 is the creation of Bitcoin, which paved the wave for fully digital, cryptographic assets. The subsequent creation of the Turing-complete Ethereum network would lead to what is now being heralded as decentralized finance.

Readers of this newsletter are likely well-aware of the events of this era, so I will not bore you with repeating them ad nauseum. Instead, let’s look at DeFi a bit closer in its historical context.

DeFi is an alternative financial infrastructure built primarily on Ethereum. Using smart contracts, DeFi replicates traditional financial services in an open and highly interoperable way. Traditional lending markets, order books/exchanges, derivatives, structured products, asset management, and more have been recreated on-chain. For a breakdown of these new DeFi primitives, I highly recommend Fabian Schär’s Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets.

Viewing DeFi as an extension of Moore’s Law and it’s counterpart in the financial markets (i.e. trading volume of derivatives), we may be approaching a kind of technological singularity in finance.

Tyler Scott Ward refers to our current state of DeFi as DeFi², a state where new projects are being built on top of base layer DeFi primitives. Eventually, newer applications will be built on these DeFi² applications, resulting in derivatives on top of derivatives. Tyler refers to this as D64, named from the result of squaring a square.

The future won’t only consist of protocols, it will also consist of the merging of technologies and protocols to build application interfaces that potentially use numerous protocols and numerous base layers to accomplish a goal. The outcome is simultaneous: a world where gaming, streaming, gambling, money management, finance, and entertainment are woven together in a fashion that creates amazing user experiences powered by base layer permissionless protocols.

As more and more assets become tokenized, wrapped, fractionalized, and interoperable, derivatives will reach a crescendo that peaks at a new financial regime for digitalized capital markets.

Whether this leads to financial contagion similar to prior historical events where derivatives that were poorly understood became popular or whether this is another boom-bust cycle of technological innovation similar to the dot-com era is yet to be seen. However, it is becoming clear that this new technological infrastructure will enable financial primitives never before thought possible at the same time that capital market frictions are being removed via easy to use DeFi infrastructure.

In the context of history, DeFi is a natural extension of Moore’s Law in the domain of derivatives and a consequence of ever more digitalized capital markets. Ultimately, we may reach a point where interoperable DeFi primitives and derivatives undergo a kind of Cambrian explosion. Imagine the potential of NFT fractionalization of real world assets, then realize those fractionalized tokens could be lent out in exchange for a yield-bearing derivative that could then be used as an avatar in a video game. It will ultimately be impossible to understand the variety of interconnections and where the risks lie. Smart contracts will ensure that it all operates as programmed, but will we ever understand it?

Regardless, the extension of Moore’s Law to finance helps us to contextualize DeFi and the coming years of v3.0 markets. The future will inevitably be tokenized.

V. Further Down the Rabbit Hole 🕳️

The Financial System Red in Tooth and Claw: 75 Years of Co-Evolving Markets and Technology by Andrew W. Lo

Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets by Fabian Schär

The History of Electronic Markets by Bankless/Tarun Chitra

Accelerated Capital is a regular publication exploring how cryptoassets, DeFi, virtual reality, and other exponential technologies are transforming our economy, society, and culture.

Be sure to subscribe to this newsletter below and follow us on Twitter.