Yield Guild Games: The Metaverse Recruitment Agency 🎮💰

Analyzing YGG's role in the migration of labor capital into the Metaverse

Table of Contents 🕹️

Introduction

Gold Farming

Play-to-Earn Gaming

Axie Infinity in the Philippines

The Yield Guild Games Model

The Rise of Virtual Nations

I. Introduction 👾

Flying Falcon, the pseudonymous purchaser of $1.5 million of digital real estate in Axie Infinity, refers to the Metaverse as a conglomeration of digital nations. Since nations are typically defined as a community of people that share a common history, culture, and territory, the Metaverse with its shared on-chain history, vibrant meme culture, and developing spatial Webaverse is best understood in this way.

The digital nation metaphor is particularly apt when assessing the macroeconomic and geopolitical forces that will ultimately shape its rise.

Let’s consider global labor arbitrage.

Global labor arbitrage is an economic phenomenon that occurs when frictions to international capital flows are removed. Without frictions, labor capital tends to migrate to nations with higher-paying jobs.

What happens when a virtual, 24/7 Metaverse accessible via mobile phone and an Internet connection creates better employment opportunities than what is available in one’s physical environs? Labor capital will migrate.

In this issue, we’ll be exploring one such employment opportunity that has emerged: Play-to-Earn gaming.

II. Gold Farming 👾

First, let’s analyze the phenomenon of Gold Farming.

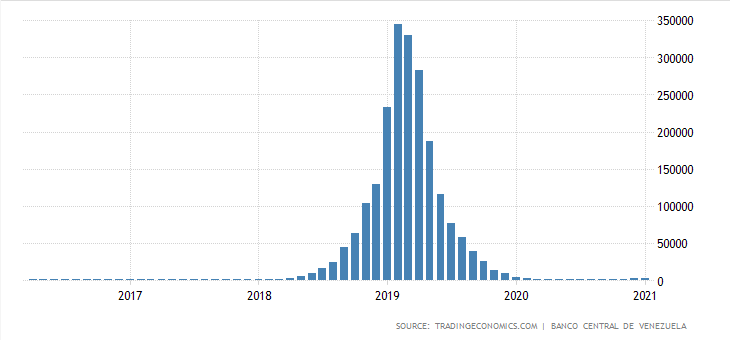

In 2010, a socioeconomic and political crisis began in Venezuela that continues to this day. It has been marked by hyperinflation, starvation, disease, crime, and massive emigration. Official estimates put the inflation rate at 53,798,500% between 2016 and April 2019.

The massive spike in inflation outpaced the rate of wage growth resulting in a situation where the monthly minimum wage was roughly $5.50 - less than the price of a McDonald’s Happy Meal. During March 2019, the Wall Street Journal reported that a teacher’s monthly salary was only enough to buy a dozen eggs and two pounds of cheese.

Given the dire economic conditions, some Venezuelans turned to gold farming in video games such as Tibia and Runescape to earn real money.

“It’s shameful. I never thought game currency would be worth more than that of our country,” says Enegebe Sención, 30, an out-of-work computer programmer who for the past five months has played Tibia to support his family.

-Excerpt from the Bloomberg Article: Desperate Venezuelans Turn to Video Games to Survive

Gold farming is the practice of playing massively multiplier online games to acquire in-game currency, which is later sold for real-world money. Gold farming can be traced back to the older phenomenon of “real money trading” or RMT, where cash payments were made to players in exchange for items or leveling up characters within text- and early graphics-based dungeon crawlers in the 1980s. The rise of MMORPGs, starting with the launch of Ultima Online in 1997, along with the birth of online marketplaces like eBay, resulted in the transformation of the RMT cottage industry into full-scaled industrialized gold-farming operations, primarily located in low-wage labor areas such as Latin America and East Asia.

Industrialized gold farming operations have historically been cast in a negative light, considered by some to be exploitative and oppressive. The label “virtual sweatshop” has even been applied to the activity. Accusations of money laundering, organized criminal activity, and fraud combined with others players’ negative sentiment around in-game currency devaluation and breaking the realism of the game world have contributed to crackdowns on the activity by game developers and governments alike. While pay and conditions are poor by Western standards, they are oftentimes as good as or better than alternatives that gold farmers face.

The history of gold farming can be framed as an evolution of a capitalistic system from subsistence production to globalization. Richard Heeks analyzed the entire value chain of gold farming economies in this 2008 paper, going so far as to view the development of gold farming operations within video games as the organic creation of an economic system. Excerpted here with modifications for conciseness:

Subsistence production: Players produce and consume items themselves.

Barter: Players producing a surplus of one item begin to barter with others who had a surplus of different items. Commoditization of virtual items begins. Items have a "use value" tied to game consumption and an "exchange value", a value in terms of other items for which they could be exchanged.

Monetization: A transition from barter of in-game items and currency to exchange of real-world currency for in-game items. Thus virtual items (including in-game currency) begin to be monetized. At this stage, markets and exchanges form to facilitate peer-to-peer trading.

Petty commodity production: Players would have initially been selling only their surplus items, but then gradually spending more time producing a surplus for sale, and less on just playing for fun. They thus started to specialize, moving on – again as we often see in developing countries today – from making money to pay for their games-playing to making cash for other real-world expenditure.

Wage labor: At some point, gold farming took the leap from petty to capitalist commodity production when the first player paid another player to gold farm for them.

Globalization/Offshoring: with wage labor forming by far the single largest cost of gold farming, it was inevitable that it would migrate to low-wage locations. Hence, the domination of Chinese playborers in gold farming, which some see as having pushed US firms out of the market.

Automation: as seen in industries from automobile manufacture to software services, the key alternative cost-cutting strategy to offshoring is automation. These are the "bots" that imitate the actions of real players, and which can be used to gather in-game items and currency.

Viewing the rise of video game capital markets in this way, we can see the natural progression of digital good economies. Blockchain technology enables a deeper level of ownership over digital assets that turns them from ephemeral products within a video game into actual assets that are directly owned.

Utilizing blockchain technology and seeking to reinvent the ownership model of in-game items, Play-to-Earn gaming embraces these natural economies and brings value creation to the forefront.

III. Play to Earn Gaming 👾

Play-to-Earn is a new innovation in the gaming industry that embraces open economies and rewards players who add value to the ecosystem through financial incentives. According to Play to Earn Magazine:

Giving gamers ownership over in-game assets and allowing them to increase their value by actively playing the game are key components of the play-to-earn business model. By participating in the in-game economy, players are creating value for other players and the developers. In turn they are rewarded with in-game assets. These digital assets can be anything ranging from cryptocurrencies to in-game resources that are tokenized on the blockchain. That’s why the play-to-earn business model goes very well together with blockchain games.

So rather than confining vibrant video game capital markets to a seedy underworld, Play-to-Earn gaming acknowledges that value creation begins with the player. Miko Matsumura, cofounder of gumi Cryptos Capital in an email to GamesBeat, discusses this shift:

[…]The evolution of game attention economics creates opportunities for both model disruption and geographic arbitrage. This is well documented in the history of gaming via companies like Machine Zone or IGN. But in traditional gaming, these relationships were exploitative, whereas in DeFi [decentralized finance] and NFT there is a great potential for the rise of play-to-earn guilds that benefit the players and their families.

-Miko Matsumura, Yield Guild Games will let players earn income from NFT games

Yield Guild Games is doing exactly this.

IV. Axie Infinity in the Philippines 👾

We believe that the future of work will be increasingly virtual, and jobs will be found inside games that have open economies.

— Yield Guild Games

Yield Guild Games (YGG) has a simple goal: onboard millions of players from around the world into the Play-to-Earn gaming revolution. To understand the genesis of YGG, let’s review the impact of Covid-19 on the founders’ local communities within the Philippines.

After the government imposed strict community quarantines measures in March 2020, unemployment spiked to 17.5% by April, triple its level in the previous quarter. From a World Bank survey conducted in August of the same year:

1 in 4 household heads lost employment.

More than 50% of those who continued working experienced disruptions.

Among households’ heads who continued working, ~47% experienced reduced income.

Before the pandemic, 24% of households reported receiving remittances, but since the start of the pandemic, 60% of those households reported receiving less or no remittances.

40% of households reported being unable to buy essential food products, with 3 out of 4 households reporting they were worried about having enough food.

The government provided relief payments, but they were nominal at best. Leah Callon-Butler highlights the Inton family’s struggles in her piece for CoinDesk:

While the government has provided some assistance, it’s hardly enough to get by. Since March, the Inton family have received two relief payments totaling 13,000 PHP ($267). Their local barangay council has tried to help further by providing handouts of rice and canned sardines, but it’s only about a week’s worth of food delivered once a month.

-Leah Callon-Butler, The NFT Game That Makes Cents for Filipinos During COVID

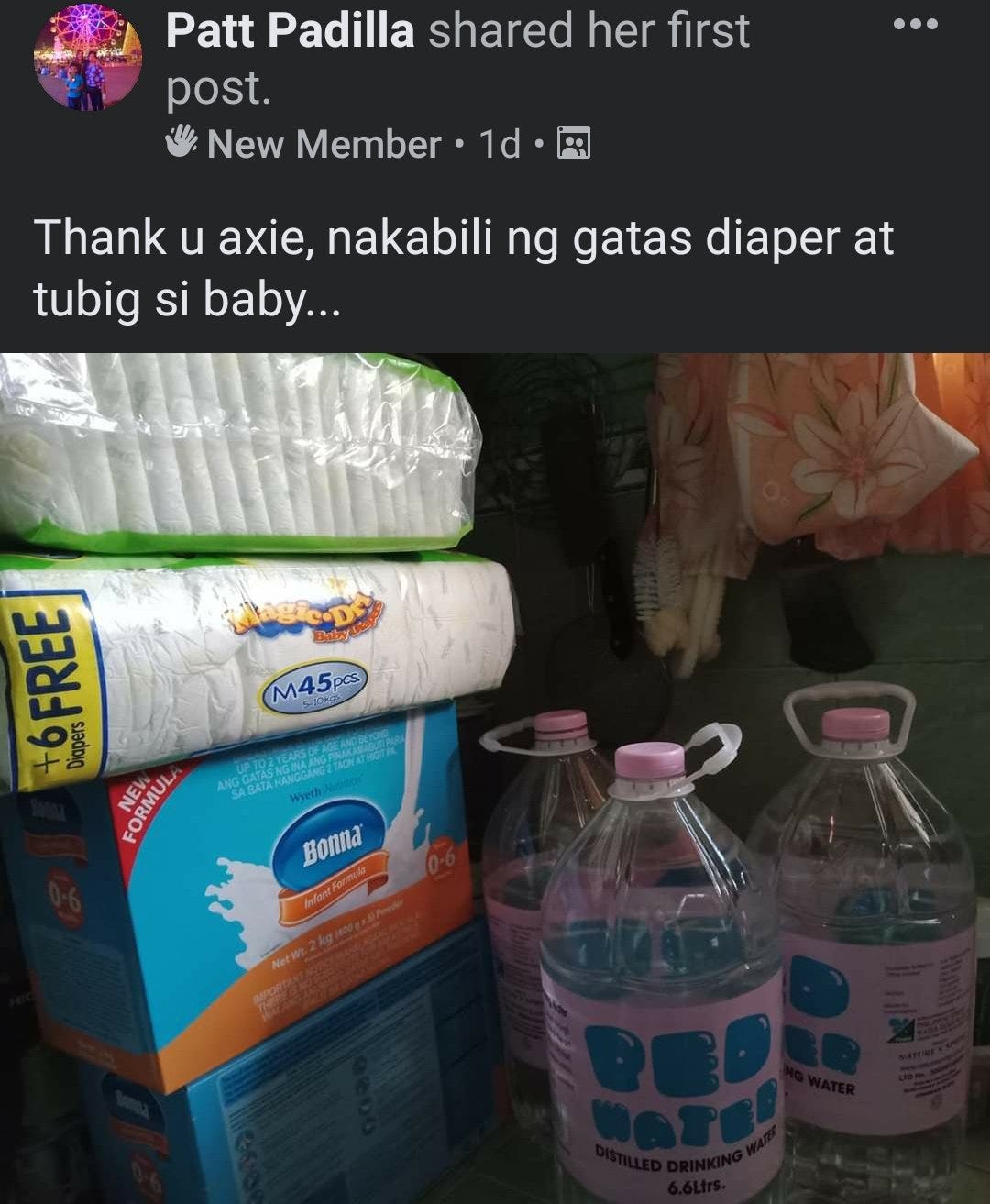

As households attempted to find ways to supplement their income during this trying time, word spread in the community about a game you could play to earn real money.

That game? Axie Infinity.

Axie Infinity is a Pokémon-inspired universe where anyone can earn tokens through skilled gameplay and contributions to the ecosystem. Players can battle, collect, raise, and build a land-based kingdom for their pets.

-Axie Infinity, Whitepaper

Axie Infinity is a blockchain game on Ethereum that uses the Play-to-Earn model to incentivize ecosystem growth. There are a few different ways to earn income from the game, but the primary way is to battle digital pets to earn Small Love Potions (SLP), an ERC20 token that is tradeable on decentralized exchanges like Uniswap or Sushiswap.

An average player can earn around $300-500 a month playing Axie Infinity, depending on how SLPs are trading at the time. In Leah’s article mentioned above, Gabby Dizon, co-founder of YGG, stated:

To a crypto investor, gaining $300 or $400 a month might not mean that much, but for these people it means the world. It’s food on the table, it’s money for their families and it’s saving them when they cannot even leave the house during this pandemic.

While this income level is a lifesaver for many people around the world, there are larger upfront costs associated with getting started. In order to play, players must own three Axies, which are currently going for at least $170 a piece.

The founders of YGG (Gabby Dizon, Owl of Moistness, and Beryl Li) looked at this situation and decided to solve it.

V. The Yield Guild Games Model 👾

We believe that ultimately, the allure of these player-owned virtual economies could eventually serve as a Trojan horse for on-boarding millions of players into crypto more broadly.

— Piers Kick and Anil Lulla, Announcing Delphi Digital’s Investment In Yield Guild

In its simplest form, YGG matches up high-quality gaming NFTs with players that are willing to grind. Using Axie Infinity as an example, YGG leases out Axies to players looking to get started with the game that might not be able to afford the initial upfront cost.

YGG recruits existing members of the community as our “scholarship managers”, who recruit and train our Axie “scholars” or players that are leasing Axies from the guild. Each manager recruits players from their respective sub-communities, trains them in how to win games in Axie Infinity, and starts them on the road of earning SLP for their families. This program is managed via bots that interact with smart contracts in our Discord server, automating the process of lending out the Axie NFTs and the revenue share of SLP between the scholar, manager, and the guild.

Players keep 70% of the SLP they produce while 20% goes to the community manager. The remaining 10% accrues to the YGG’s treasury.

This model is not limited to Axie Infinity. YGG currently operates in a variety of games including Gods Unchained, League of Kingdoms, The Sandbox, and more. They have announced large land acquisitions in a few of these digital worlds, such as a 12x12 estate purchase in The Sandbox and a purchase of 235 plots of land in Axie Infinity.

The largest expansion outside of Axie Infinity to date has been in League of Kingdoms. In this multiplayer blockchain strategy game, players can purchase land as ERC721 NFTs, with each land owner receiving 5% of in-game resources harvested by players on their land. In addition, 10% of revenue generated from in-app purchases are shared with all land owners, scaling with the land’s in-game level, incentivizing players to develop their land to maximize their returns.

YGG has experimented with tokenizing their in-game land estate within League of Kingdoms. The 286 parcel estate has been fractionalized into 286,000 YGGLOK tokens available to active members of the YGG Alliance.

We are sowing the seeds for building a new economy in the Metaverse, and supplying the people who are willing and able to perform the jobs (battling, breeding, trading etc.) to develop this new virtual-first economy.

In this way, YGG is a Metaverse real estate investment trust (REIT). Delphi Digital says it best in the announcement of their investment in YGG during the most recent $1.325M seed round:

From the end user perspective, Yield Guild provides a valuable service to NFT collectors and *whales* within crypto. As most of us know, the opportunity cost of time in this space for people deep in the weeds is very high. Because of this, a lot of crypto enthusiasts and speculators aren’t able to fully leverage functional NFTs which they may have invested a lot of capital in. YGG will become an efficient bridge between the supply side of these lucrative assets, and the demand side from players who are eager to perform yield-generating activities but might be unable to afford the highest-end assets.

-Delphi Digital, Announcing Delphi Digital’s Investment In Yield Guild

This REIT model means YGG becomes a “black-hole” for NFTs.

YGG acquires high-quality NFT gaming assets.

YGG lends out these assets to players seeking to earn income.

Revenue is split between the player and the guild’s treasury.

The YGG treasury is then used to acquire additional high-quality NFT gaming assets to lend out.

In this way, YGG’s treasury becomes an investment fund for productive NFTs in some of the most popular blockchain games. YGG benefits from having a large network of players that could offer the guild insights into the latest NFT gaming trends, while also providing an opportunity to work with new games in developing their products. As an example of the latter, YGG recently announced a strategic partnership with Illuvium, investing in the new blockchain game’s seed round alongside a network of institutional investors including IOSG, LD Capital, Delphi Digital, YBB Foundation Ltd, Stake Capital, Moonwhale Ventures, Lotus Capital, Blocksync Ventures and Bitscale Capital.

YGG has expressed an intent to become a fully operational Decentralized Autonomous Organization (DAO), where each step of the on-boarding and distribution processes are automated via smart contract. This will turn it into a highly-efficient Metaverse on boarding platform.

Which leads to the deeper level of the YGG thesis:

I see YGG as a recruitment agency for the metaverse.

— Yat Siu, Why we invested in Yield Guild Games

VI. The Rise of Virtual Nations 👾

“For me, it’s like we’re settling a new nation in the same way that America was being settled in the 1700s. We’re now settling a digital nation with people who are aiming for a home from around the world.”

-Gabby Dizon, You can make money playing in virtual worlds: Gabby Dizon

Play-to-Earn gaming is just one avenue of work in the Metaverse. It’s enabled by web3 technologies and a reinvention of the ownership model for digital assets and community platforms. Game theory is adapted to create attention economies that reward all ecosystem participants.

As we see further migration of labor capital into the Metaverse, from employing real humans to greet people in virtual casinos to vibrant creator economies owned and operated by community-led DAOs, one thing is certain:

Digital nations are forming, and the migration of capital has just begun.

Looking to get involved with Yield Guild Games? Hop in their Discord or check out this article.

Be sure to subscribe to our newsletter below and follow us on Twitter to remain on the bleeding edge of the Web3 revolution.

In each issue, we’ll explore how cryptoassets, DeFi, virtual reality, and other exponential technologies are transforming our economy, society, and culture.